Mastering the 30-Day Notice of Intent to Foreclose

BEFORE YOU ORDER, READ THIS: please enable pop-ups when you reach the PayPal website.

Mastering the 30-Day Notice of Intent to Foreclose – How to Maximize Profits and Minimize Waste in Preparing the Pre-Litigation Notice for an Arizona Property Tax Lien Foreclosure, by Mark L. Manoil, Capital West Publishing, Phoenix. Publication date: October, 2009. 22 pages, illustrated, endnotes referencing statutory and case law.

All too often easily avoided mistakes can cause the tax lien investor to have to defend legal foreclosure at great expense, sometimes more than the value of the tax parcel itself! Since the pre-litigation notice requirement was first imposed in 1994, I have developed a system to master the notice process.

This report explains the “5 Ws” of preparing the pre-litigation notice as a strong foundation for the tax foreclosure action (and Treasurer’s Deed) that follows:

- Who needs to get the notice

- What needs to be included in the notice of intent to foreclose

- When the notice can be mailed and duration of its effectiveness

- Where and how to do the mailing

- Why mistakes can cause delays and expense and how to avoid them

Who should find this useful?

- Property tax lien buyers

- Portfolio servicers/managers

- Attorneys who handle tax lien foreclosures

- Title insurance underwriters and claims administrators

See Table of Contents below.

From the Executive Summary:

The purpose of this pamphlet is to assist investors and servicers who are preparing the pre-litigation notice to do it properly, and to minimize delays and the risks of invalidation and failure of the ensuing foreclosure. Additionally, preparation and sending of the notice can be approached with the goal of resolving the tax lien more quickly: either enhancing the likelihood of redemption of the tax lien being noticed; or identifying a deed-in-lieu of foreclosure opportunity. Because the tax lien foreclosure action itself moves rather slowly over a period of months, obtaining lien redemption without the necessity of filing the foreclosure is in most cases the best way for the investor to achieve a return on its investment. If the notice can actually reach the hands of the property owner, and that party is not sufficiently interested to redeem, the owner might be willing to sign and deliver a deed to avoid being named in the foreclosure action, or cooperate with the foreclosure.

While the statute speaks for itself, a discussion of its various aspects will assure notice preparers that they are avoiding what could turn out to be expensive or time-consuming mistakes. Additionally, certain types of record keeping in connection with the preparation and sending of notices should be established to obtain maximum value from the effort.

Here are the topics we address: A) contents of the notice of intent to foreclose; B) parties to whom the notice is required to be sent; C) timing of the mailing of the notice; D) manner of mailing; and E) consequences of mistakes in the preparation and sending of the notice. Finally, we offer in the last section a step-by-step guide (with forms) to preparing the notice and documenting your work.

It is risky and potentially wasteful to underestimate the importance of properly preparing and sending the 30-day notice. The conservative approach recommended here should lead to unquestionably satisfactory notices that comply with the statutory requirement, and thus a sure footing for the foreclosure and tax title that follow.

Table of Contents for Mastering the 30-Day Notice:

Executive Summary

I. Introduction and Background

II. Elements of the Thirty Day Notice

A. Contents of the notice of the intent to foreclose

1. Property owner’s name

2. Real property tax parcel identification number

3. Legal description of the real property

4. Certificate of purchase number

5. Proposed date of filing the action

County treasurer’s office contact information

Contact information for the investor or its representative

B. Parties to whom the notice is to be sent

C. Timing of the Notice

D. Manner of Mailing

E. Mistakes in preparing and sending the notice

III. A step-by-step guide to preparing and documenting the preparation of a valid 30-day notice of intent to foreclose

IV. Conclusion

Endnotes

Research Resources

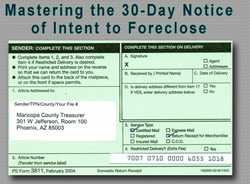

Illustrations

1. Spreadsheet format for collecting data for notices

2. Short-form notice without CP investor contact information

3. Longer-form Notice with invitation to contact CP investor or representative.

4. Name and address labels – 3 across

5. Addressee side of certified mail return receipt

6. Return address side of certified mail return receipt

7. Certified mail – addressed envelope.

8. Certified Mail Receipt – showing address of notice and evidence of mailing

9. Labeled file folders

10. Additional spreadsheet columns for notice tracking

Closing notes to potential buyers of Mastering the 30-Day Notice of Intent to Foreclose:

Certificate of Purchase (tax lien) buyers: You buy CPs with the hope and expectation that you’ll either earn interest or obtain a deed as a result of your investment. Probably the last thing you want to do is spend lots of money in court, defending the validity of your Treasurer’s Deed.

This report, which includes citations to applicable statutory and case law and a step-by-step guide, will help you prepare notices correctly, and avoid costly mistakes and delays from having to redo inadequate notices or defend questionable notices in court or on appeal. You’ll be able to clear out the tax liens that are most likely to redeem before having to send them to your attorney to process. And if you typically have your attorney prepare the notices, you’ll want to make sure he or she reads the report (after you do)!

You will get the tools to maximize returns from your investments while minimizing risks and cost items that detract from returns.

Attorneys: If you handle property tax lien foreclosures on an occasional basis, first steps in the process could be putting you and your clients at substantial risk.

Arizona’s legislature recently made the 30-day notice of intent to foreclose, which must be given prior to starting foreclosure, a jurisdictional requirement. Presumably, you don’t want to be creating case law about what constitutes a “substantial failure to comply.

The special report, which includes citations to applicable statutory and case law, will help you prepare notices correctly (or evaluate notices prepared by your client), build strong files, and be confident in commencing foreclosure actions.

Title Insurance Underwriters/Claims Administrators: The challenge to a tax title based on inadequacy of the (pre-litigation) 30-day notice of intent to foreclose – how do you evaluate it? Recent Court of Appeals Memoranda Decisions indicate that parties (or their title insurers) are spending thousands, if not tens of thousands, of dollars litigating these fine points, sometimes more than the value of the tax parcel itself!

This special report will help you to evaluate title claims based on procedural challenges to tax titles. Also, after reading the report you may decide to revise your company’s underwriting practices on tax titles, to include a review of the underlying pre-litigation notices. Make better underwriting and claims decisions by ordering now.

Note: Arizona residents pay an additional 9.3% sales tax for purchases from this site. FOR PROPER CHECK OUT ON PAYPAL, PLEASE ENABLE POP-UPS.